|

Knowing when to be more direct and straightforward is a balance in all relationships-new or old. It is not my style to be conversationally direct unless provoked or I’m angry. As I raise my teenagers, however, I’m direct when needed, but I’m also known to provide all the context clues and allow them the lee-way to figure out certain experiences on their own.

To be honest, I have my occasional conversational meanderings. My trouble is I can spend too much energy trying to convey a thought to someone with style and grace, that I sometimes miss the opportunity to be direct, succinct, on-point, and absolute. Below is a case in point. Over this past summer, I was gently scolded (in a fatherly way) by a long-time client who is an octogenarian. We were revisiting what would happen when he passed away. He wanted to know how his wife would continue receiving their income stream and other retirement benefits they had accumulated. During the course of this conversation, I kept referring to his death as his “passing away.” After a while, he finally had enough of me saying “passing away” and said Matt, “I’m going to DIE, but hopefully not today or tomorrow.” He asked me, “and where am I passing to or passing by; the bus station, the airport on my way to check out?” He said, with a quiet confidence, “I know where I’m going at my death.” He said, “I will die and you can refer to my passing as my death, there’s no need to be gingerly about it.” His point was well taken, it was unnecessary to be so sensitive to the issue as if he hadn’t thought about his own mortality. His point too was that it was almost impolite to be so delicate with a known fact—we’ve had a long established relationship. Ultimately, what he was trying to communicate to me was that we didn’t reconcile time in the same way, not because of our age difference but because if I didn’t come to the end of my meeting soon, he was going to die of hunger. Be direct, succinct and on-point, you’ll help your relationships live longer. Peace & Prosperity, Matthew D. Peck

0 Comments

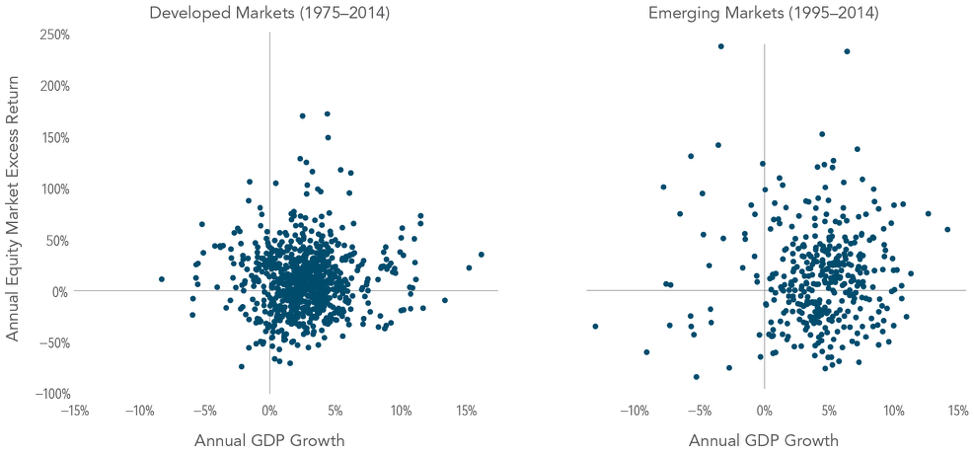

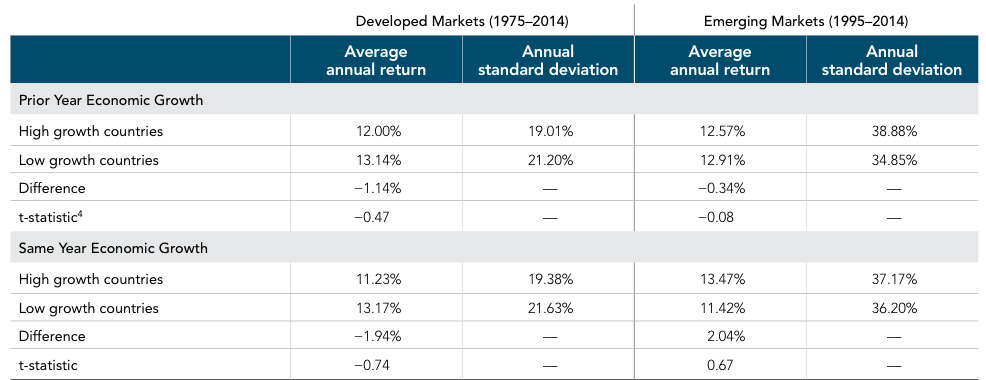

A relevant question for many investors is whether their view of economic growth should impact how they invest. Opinions about future economic growth often differ across market participants. For example, in a survey of more than 60 economists conducted by the Wall Street Journal in June 2016, estimates of US GDP growth in 2017 ranged from 0.2% to 3.7%.[1] A relevant question for many investors is whether their view of economic growth should impact how they invest. In this regard, they may be surprised to find that the historical link between annual GDP growth and equity returns has been quite weak. Exhibit 1 shows annual GDP growth vs. annual returns for developed and emerging markets. These plots indicate that there has not been a strong relation between GDP growth and equity returns in the same year. For example, in developed markets country/year combinations [2] when GDP growth was positive, the spread in returns was substantial: 323 country/year combinations had returns above 10% while 192 country/year combinations had returns below −10%. We see a similar pattern in realized returns for developed markets country/year combinations when GDP growth was negative. Emerging markets show a similar pattern. Exhibit 1. Annual GDP Growth and Equity Market Excess Returns Sources: World Bank, MSCI, Morningstar. Shorter time periods shown for some countries due to data availability. Past performance is no guarantee of future results. See Data Appendix for details. Despite this weak relation between GDP growth and stock returns in the historical data, investors often ask whether shorter-term fluctuations in economic cycles impact stock returns in the near term. Stated differently, while on the surface Exhibit 1 presents a weak picture of GDP growth and stock returns in the same year, is there a relationship between the two that is not obvious from this exhibit? To address this question, we examine 23 developed markets from 1975 to 2014 and 19 emerging markets from 1995 to 2014.[3] Each year, countries are classified as either high or low growth depending on whether their GDP growth was above or below that year’s median GDP growth, defined separately for developed and emerging markets. We then look at stock market returns of high and low growth countries over the following year. The return for each group of countries is the average stock market return of all countries in the group weighted by countries’ market capitalization weights. Exhibit 2 shows that, historically, differences in GDP growth over the past year contained little information about differences in equity returns this year. In both developed and emerging markets, average annual returns were similar for high and low growth countries. In fact, low growth countries had slightly higher average returns than high growth countries, although this return difference was not reliably different from zero. In other words, there is no evidence that this return difference occurred by anything other than random chance. Exhibit 1. Equity Returns and Economic Growth in High and Low Growth Countries Sources: World Bank, MSCI, International Finance Corporation (World Bank). Past performance is no guarantee of future results. Filters were applied to data retroactively and with the benefit of hindsight. Returns are not representative of indices or actual strategies and do not reflect costs and fees associated with an actual investment. Actual returns may be lower. Please see Data Appendix for more information. Can superior forecasts of short-term future economic growth help improve investment decisions? To address this question, we extend the analysis and assume perfect foresight about GDP growth over the next year. We now study the returns of high and low growth countries over the same year we measure GDP growth. This is not an implementable strategy because investors do not have the advantage of knowing economic growth in advance. They must rely on GDP forecasts, adding additional uncertainty. Exhibit 2 shows that even under the assumption of perfect foresight, using GDP data would not have generated reliable excess returns for investors. In developed markets, low growth countries had higher average annual returns than high growth countries, whereas in emerging markets, high growth countries had higher average annual returns than low growth countries. Neither difference in returns was reliably different from zero. This suggests that markets quickly incorporate expectations about future economic growth, making it difficult for investors to benefit from growth forecasts even with the advantage of perfect foresight. Differences in equity returns across countries seem to be driven more by differences in discount rates than by differences in GDP growth, even under a perfect forecasting scenario. Conclusion Many investors look to economic growth as an indicator of future equity returns. However, the relation between economic growth and returns in the historical data has been shown to be weak. This should not come as a surprise given that returns are determined by discount rates and investors’ aggregate expectations of future growth. Surprises relative to those expectations, whether positive or negative, may cause realized returns to differ from expectations. The evidence presented here suggests that differences in GDP growth contain little information about differences in stock returns in the same year and over the subsequent year. This means that it is difficult for investors to earn excess returns by relying on estimates of current or future GDP growth—even estimates that perfectly forecast GDP growth over the next 12 months. [1]. “Economic Forecasting Survey,” Wall Street Journal, http://projects.wsj.com/econforecast. [2]. Each observation in Exhibit 1 represents, for one country in one calendar year, the equity market excess return over one-month US Treasury bills as well as the rate of GDP growth. For example, one of the observations shows that in the US in 2014, the equity market excess return was 12.7% and GDP growth was 2.4%. [3]. See Data Appendix for details. 2015 GDP growth data was not available for most countries at the time of writing. [4]. A t-statistic is a measure for the reliability of an average return difference. Normally, a t-statistic of at least 2 in absolute value is necessary to reliably say that the result is different from zero. Data Appendix

Developed markets since 1975 (unless stated differently): MSCI Australia Index (net div.), MSCI Austria Index (net div.) (from 1980), MSCI Belgium Index (net div.), MSCI Canada Index (net div.), MSCI Denmark Index (net div.) (1980), MSCI Finland Index (net div.) (1988), MSCI France Index (net div.), MSCI Germany Index (net div.), MSCI Hong Kong Index (net div.), MSCI Ireland Index (net div.) (1988), MSCI Israel Index (net div.) (1999), MSCI Italy Index (net div.), MSCI Japan Index (net div.), MSCI Netherlands Index (net div.), MSCI New Zealand Index (net div.) (1988), MSCI Norway Index (net div.), MSCI Portugal Index (net div.) (1990), MSCI Singapore Index (net div.), MSCI Spain Index (net div.), MSCI Sweden Index (net div.), MSCI Switzerland Index (net div.) (1981), MSCI United Kingdom Index (net div.), and the MSCI USA Index (net div.). All of the following emerging markets are included since 1995 for Exhibit 1. For Exhibit 2, since 1995 (unless stated differently): MSCI Brazil Index (gross div.), MSCI Chile Index (gross div.), MSCI China Index (gross div.) (from 1996), MSCI Colombia Index (gross div.), MSCI Egypt Index (gross div.) (1998), MSCI Greece Index (gross div.), MSCI Hungary Index (gross div.), MSCI India Index (gross div.), MSCI Indonesia Index (gross div.), MSCI Korea Index (gross div.), MSCI Malaysia Index (gross div.), MSCI Mexico Index (gross div.), MSCI Peru Index (gross div.), MSCI Philippines Index (gross div.), MSCI Poland Index (gross div.), MSCI Russia Index (gross div.) (1998), MSCI South Africa Index (gross div.) (1996), MSCI Thailand Index (gross div.), MSCI Turkey Index (gross div.). A country is included in the analysis for Exhibit 1 in a given year if MSCI index return and GDP growth data are available and in the analysis for Exhibit 2 if MSCI index return, country weight, and GDP growth data are available. Returns are in USD. GDP growth is real GDP growth in local currency, converted to USD using constant 2005 USD as provided by the World Bank. Source: Dimensional Fund Advisors LP. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Past performance is no guarantee of future results. There is no guarantee an investing strategy will be successful. |

Archives

March 2021

Categories |

RSS Feed

RSS Feed