|

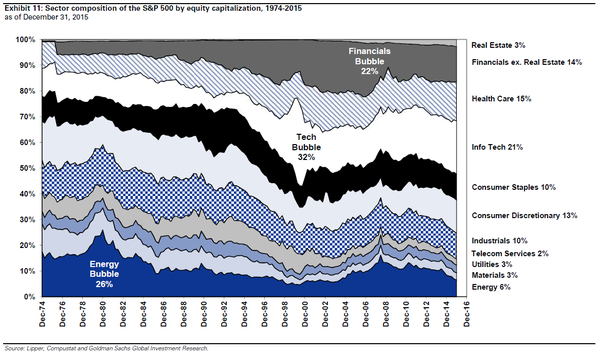

Cheers! Welcome to 2016! Winter is Coming! Oh wait, it is here in full swing in West Texas. I can’t help but to begin this Annual Review by mentioning the Great Texas Blizzard of December 2015. This winter weather system was an incredible act of nature. We would have to go back to the mid- 50s to recall such a historic snowfall and technical definition of “blizzard” conditions. All across the Texas South Plains snow estimates ranged from 2 to 20 inches of snow, with snowdrifts ranging from 3 ft. to 15 ft. in many places. As anticipated, many members of the community came together to volunteer their equipment and provide assistance to help dig out the surrounding communities. It was much appreciated! To some across the country it may seem that “Winter Storm Goliath” was no big deal. I offer this snowfall graphic for perspective. It was a massive snowstorm— if you live here you already knew that! I also offer a link to a blog post called ‘Blizzards and Bullsh*t’ by blogger Dairy Carrie—I won’t apologize for the language, most of us read far worse on social media platforms. Her blog post provides in graphic detail the devastation cattle ranchers are currently facing and how challenging life can be for both dairy farmers and cattle ranchers. She also addresses a few asinine concerns animal activists have about why cattle are not all raised in barns. It’s an interesting and colorful post. Recent estimates indicate 30,000 head of cattle have been lost due to the winter storm. Blog link: http://dairycarrie.com/2015/12/30/winter-storm-goliath/#comments Winter Wonderland in Texas As for my family and I, we were glad to be able to enjoy the snowfall. Here’s a few pictures that captured our winter wonderland experiences in Texas. My daughter standing in the middle of Hickory Street in Levelland, TX. We captured this picture of a guy sledding on a car hood on Hickory St. Not Lake Tahoe, Aspen or Telluride…Ski Apache, NM, an 85” snow base. Best snow I’ve ever experienced at Ski Apache! Update On Oil Prices—Who Knows? A noted junk bond manager recently quipped that “there’s nothing intelligent to say about the future price of oil.” There’s much more to this context but I mostly agree. I’m eating my words from this time last year when I mentioned that the oil price decline would be a powerful shot in the arm for global growth—my goodness. I will avoid a folly opinion and point to a graphic highlighting what I hope is more interesting and important to disciplined investors. Asset bubbles real or perceived should not be a reason for avoiding the stock market altogether. As one market segment tanks, others will do well. For long-term, highly diversified, disciplined investors, “bubbles” don’t matter. The danger occurs when you concentrate risk and put too much emphasis on a particular asset class or market sector. You will never know when a “bubble” will burst. If you recall the recent Oil Bubble Bust came early last fall with no warning, for no particular rhyme or reason. This is of course coming from an investment standpoint. If you are employed by the oil industry, your focus is maintaining employment, and I empathize. Venerable or Vulnerable Vanguard, Accusations of a Tax Evasion Scheme I first read about this whistleblower lawsuit against Vanguard in August of 2014, I found it very curious and eagerly waited for more details. Surprisingly, this story has not caught the attention of others in the very opinionated advisory community. Personally, I find these allegations against Vanguard the most interesting topic of personal finance in all of 2015. I would not describe myself as a “boglehead,”—a term that is used to describe a devotee to Vanguard’s approach to investing based on the name of John Bogle, the founder of Vanguard. Though, I do have a healthy respect for the world’s largest mutual fund company. In fact, within the firm we do often recommend Vanguard funds and our family owns a couple Vanguard funds. Essentially, about 2 years ago, David Danon, a former Vanguard tax attorney (the whistleblower) filed formal complaints with the Internal Revenue Service and other state taxing agencies claiming that Vanguard’s low fees are an illegal tax scheme. He lays out an argument that Vanguard should have charged investors almost $20 billion in investment management fees and claims that Vanguard owes around $35 billion in taxes, interest and penalties going back to 2007. In the details of his whistleblower allegations, he cites IRS Code Section 482 that requires transactions between related companies to take place at the same price as if the companies were unrelated. Mr. Danon believes that Vanguard provides services to its mutual funds/related entities at “artificially low, at-cost” prices, skirting accepted U.S. tax law. Because of its unique business structure, Vanguard shows little to no profit despite managing nearly $3 trillion in assets. Mr. Danon asserts that Vanguard’s business structure enables the company to underprice competitors to gain an unfair advantage and its dominance in the industry is related to tax evasion. These allegations are incredible to say the least! There does seem to be a bit of merit to the case and the allegations, as other states have been reviewing Vanguard’s financial reporting. Texas was the first state to reach a settlement with Vanguard over back taxes. It marks the first payout from Mr. Danon’s contention that Vanguard has not been forthcoming with its accounting between entities—though Vanguard claims the settlement is from a routine tax audit. In news reports it does appear that Mr. Danon was able to receive whistleblower compensation for the Texas settlement. So what does this ultimately mean for Vanguard mutual fund investors? It’s still too early to know for sure, there are many complexities. If the IRS decides to get involved and settlements are reached, mutual fund expense ratios could go nominally higher, as hefty amounts of taxes could be owed. Vanguard is an enviable and mighty competitor in the investment management industry. In 2015, it raked in $76 billion in new cash from investors. The company has a large mark on its back and I anticipate taxing authorities and competitors will all want a piece of Vanguard’s perceived troubles. Link to a white paper abstract from Reuven S. Avi-Yonah, University of Michigan Law School – Too Big to Tax? Vanguard and the Arm’s Length Standard http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2666426 A New Year Brings New Speculation In this last section, I will repost the thoughts of Jim Parker of Dimensional Fund Advisors. As you will read, Jim highlights the folly of financial predictions. We all have thoughts and opinions about what could be. Jim lists 10 predictions you can count on coming true in 2016. 2016: Ten Predictions to Count OnBy Jim Parker, of Dimensional Fund Advisors

The New Year is a customary time to speculate. In a digital age, when past forecasts are available online, market and media professionals find it harder to hide their blushes when their financial predictions go awry. But there are ways around that. The ignominy that goes with making bold forecasts was highlighted in a recent newspaper article, which listed many bad calls US economists had made about 2015. These included getting the timing of the Federal Reserve’s interest rate increase wrong, incorrectly calling for a rise in long-term bond yields, and assuming an end to the commodity rout.1 For the broad US equity market, 22 strategists polled by the Wall Street Journal2 estimated an average increase for the S&P 500 of 8.2% for 2015. The most optimistic individual forecast was for a rise of 14%. The least optimistic was 2%. No one picked a fall. As it turned out, the benchmark ended marginally lower for the year. In the UK, a poll of 49 fund managers, traders, and strategists published in early January 2015 forecast that the FTSE 100 index would be at 6,800 by midyear and 7,000 points by year-end. As it turned out, the FTSE surpassed that year-end target by late April to hit a record high of 7,103 before retracing to 6,242 by year-end.3 Australian economists were little better. The consensus view, according to a January 2015 Fairfax Media poll, was that local official interest rates would stay on hold all year. The Reserve Bank of Australia proved that wrong a month later, before cutting rates again in May. It shouldn’t be a surprise that if economists can’t get the broad variables right, it must be tough for stock analysts to pick winners. Even a stock like Apple, which for so many years surprised on the upside, disappointed some forecasters last year with a 4.6% decline.4 In Australia, the “Top Picks for 2015” published by one media outlet a year ago included such names as Woodside Petroleum, BHP Billiton, Origin Energy, and Slater & Gordon, all of which suffered double-digit losses in the past year.5 It should be evident by now that setting your investment course based on someone’s stock picks or expectations for interest rates, the economy, or currencies is not a viable way of building wealth in the long term. Markets have a way of confounding your expectations. So a better option is to stay broadly diversified and, with the help of an advisor, set an asset allocation that matches your own risk appetite, goals, and circumstances. Of course, this approach doesn’t stop you or anyone else from having or expressing an opinion about the future. We are all free to speculate about what might happen in the economy and markets. The danger comes when you base your investment strategy on such opinions. In the meantime, if you insist on following forecasts, here is a list of 10 predictions you can count on coming true in 2016:

You can see from that list that if forecasts are so hard to get right, you are better off keeping them as generic as possible. Like a weather forecaster predicting wind, hail, heat, and cold over a single day, your audience should prepare themselves for all climates. The future is always uncertain. There are always unexpected events. Some will turn out worse than you expect; others will turn out better. The only sustainable approach to that uncertainty is to focus on what you can control. In the meantime, let me wish a happy new year to you all. 1. Malcolm Maiden, “The Year Market Economists Failed to See Coming,” SMH, December 30, 2015. 2. “Strategists Expect Stocks to Keep Climbing in 2015,” Wall Street Journal, January 2, 2015. 3. “Five Fund Strategies to Ride Rising Markets,” The Times, January 3, 2015. 4. “Seven Stocks to Buy for 2015,” CNN Money, December 31, 2014. 5. “Top Stock Picks for 2015,” Motley Fool. I look forward to visiting with you in 2016. Be ready to hang on to your hat, 2016 is already interesting. Regards, Matthew D. Peck Client Advisor & Partner Amicus Financial Advisors, LLC

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

March 2021

Categories |

RSS Feed

RSS Feed